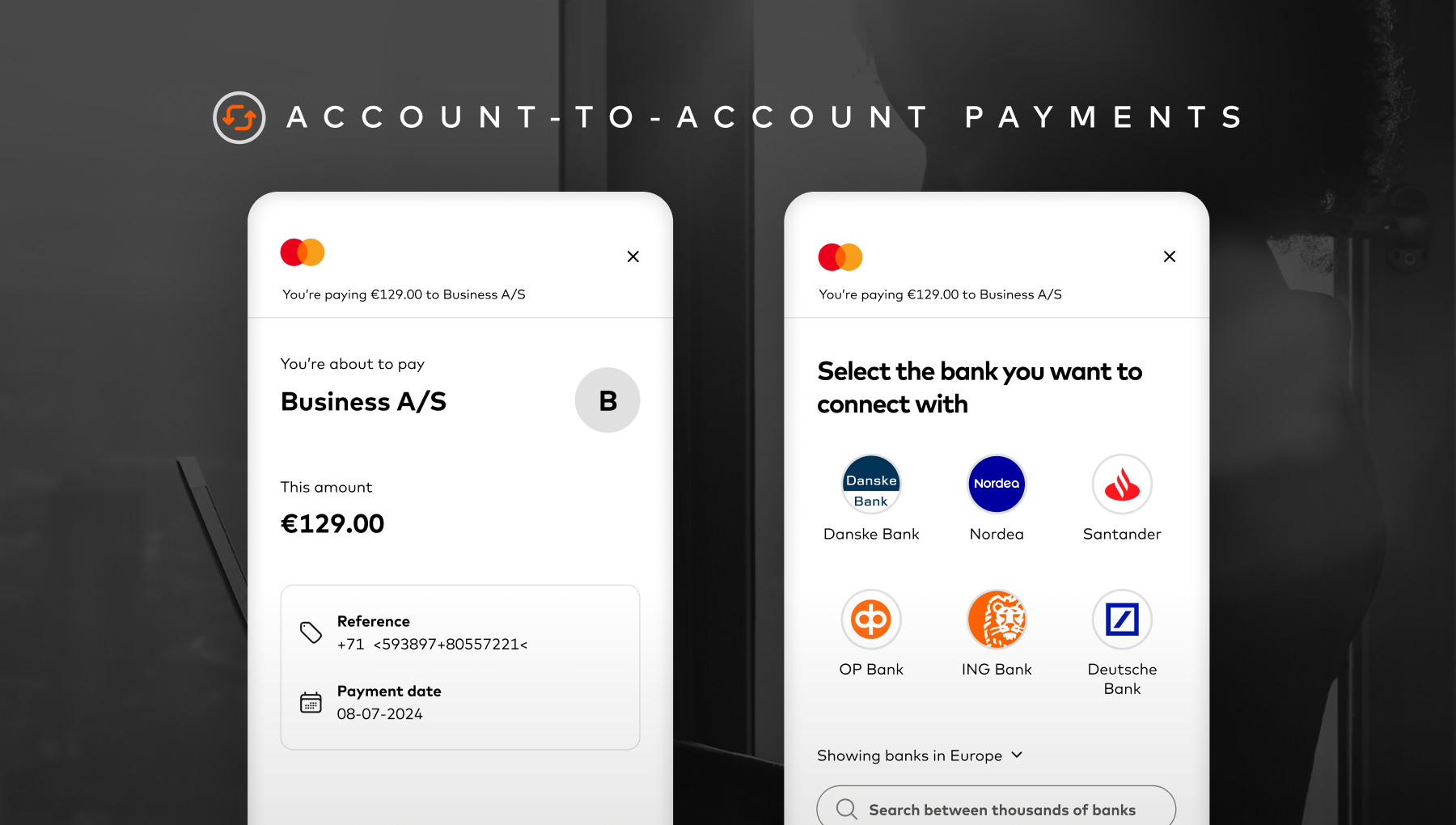

Since the payment is initiated directly from the consumer’s bank account based on the trusted authentication service provided by the banks, consumers get more transparency on available balance and can rely on a secure way to pay.

Benefits for consumers:

- Simplicity: No need to remember bank account details or type in long card numbers

- Visibility: Bank account balance is visible before deciding to pay, reducing the risk of payment failures

- Security: Safe and easy payments using the bank’s usual online or mobile app login details to verify the payment

With the largest payment volume of all online payment services in Finland, Paytrail is the leading Finnish online payment service provider – and a part of Nexi Group. Paytrail has been working with Mastercard Open Banking since 2019 and their Chief Operating Officer shares his views on the benefits of teaming up with an open banking provider like Mastercard:

The integration with Mastercard has made it possible for us to get the solution up and running fast to offer thousands of merchants the opportunity to leverage open banking payments. Without the partnership, we would have had to build integrations to all the banks ourselves, and it would have been a very challenging task for sure.”

Joni Rautanen, Chief Operating Officer, Paytrail, a part of Nexi Group.

If you want to explore more about open banking use cases and opportunities, head over to openbankingeu.mastercard.com

Are you curious to learn more about how you can build customer-centric payment solutions with open banking?

Download Mastercard’s open banking payment report and see how you can win the ecommerce space with open banking, or head over to Mastercard’s open banking blog for more inspirational use cases.