The importance of being flexible

With the number of Buy Now, Pay Later (BNPL) solutions increasing in supply, it’s important that merchants can easily switch – and also add on, providers. Interestingly, BNPL is also in high demand, especially by younger age groups.

For example, Gen Z (born 1997 – 2012) is the generation that uses BNPL the most (and whose use is on the rise.) Their adoption rates are expected to increase from 36.8% in 2021 to 47.4% in 2025, according to eMarketer. (Millenials born 1981-1996 have a similar pattern; with usage increasing from 30.3% in 2021 to 39.5% in 2025.)

By offering different types of payment options in their web shops and including one (or even several) BNPL options, merchants can ensure that their customers have access to the payment methods that they prefer. Regardless of their age. And this of course helps increase their likelihood of completing an online purchase!

Why is Buy Now, Pay Later increasingly popular?

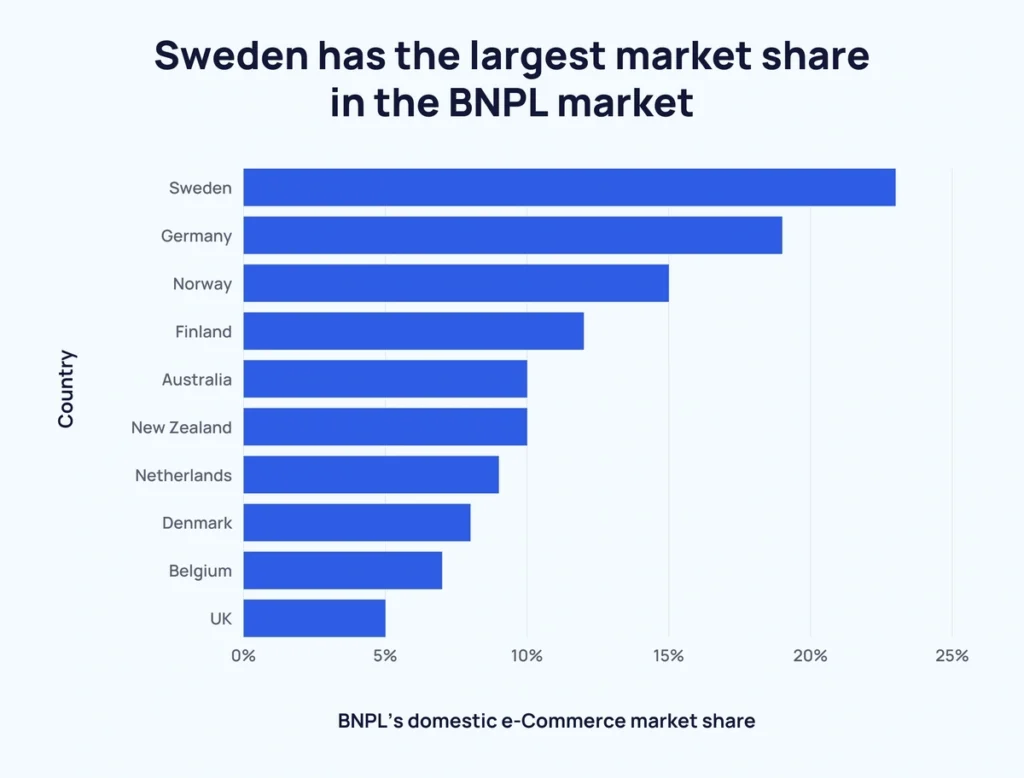

The growth of Buy Now Pay Later (BNPL) in Europe has been significant in recent years, driven by increasing consumer demand for more flexible and convenient payment options. According to recent reports, the BNPL market in Europe is expected to grow at a compound annual growth rate (CAGR) of over 30% from 2020 to 2025.

This growth is driven by several factors, including the increasing popularity of e-commerce, the growing preference for digital payments, and the rise of mobile commerce. In addition, many European consumers are attracted to the flexibility and control that BNPL offers, allowing them to spread the cost of their purchases over time and manage their finances more effectively. With its strong growth trajectory, BNPL is expected to play an increasingly important role in the European payment landscape in the years to come.

Why does your customer prefer a specific BNPL loan provider?

Well, the answer is partly in the question. When choosing to use a BNPL provider, a customer is actually accepting a loan financing with less steps. But at the end of the day (and the end of the repayment period), it’s still a loan.

We see that customers may choose one Buy Now Pay Later (BNPL) provider over another based on several factors, including:

- Interest rates and fees: Some BNPL providers may offer lower interest rates or fees than others, making them a more attractive option for cost-conscious customers.

- Eligibility criteria: Different BNPL providers may have different eligibility criteria, such as credit score requirements or minimum purchase amounts, which could impact a customer’s ability to use the service.

- Repayment terms: The terms of repayment, such as the number and frequency of payments, may vary between BNPL providers. Customers may choose a provider that offers terms that align with their personal circumstances and budget.

- Merchant network: The number and types of merchants that accept a particular BNPL provider can be an important factor for customers. Customers may choose a BNPL provider that is widely accepted at the merchants they shop with.

- Customer experience: The customer experience can also play a role in a customer’s decision to choose one BNPL provider over another. Factors such as the ease of use, customer service, and security features can all impact a customer’s decision-making.

Think win-win!

Ultimately, customers may choose a BNPL provider based on a combination of interest rate, fees, repayment terms, and so on. Their goal when shopping would be to find the goods and services— and how to pay for them— that best fits their needs and preferences.

Regardless of their age or where they shop. Your goal as a merchant should be to choose a flexible online payment solution for e-commerce which can easily support multiple BNPL options. So you can pass on this flexibility to your customers, improving their shopping experience— and your bottom line.

Vlad Gidea

Senior Product Marketing Manager

Vlad is Senior Product Marketing Manager at Nets and works with product updates, including campaigns and customer communication within ecommerce and digital payments.

- Topics