An easy online payment experience

We know that merchants who operate an ecommerce business strive to make the online customer experience a pleasant one. Their goal is to make the transition from online browsing to online payment quick— and importantly— hassle-free, for the customer. To ensure the shopping cart is not abandoned, the checkout process must be simple, intuitive, and convenient.

And here is where “frictionless payments” come in. Frictionless payments mean that online and offline checkout processes are designed to ensure barriers to buying have been minimized. It is a broad term that includes mobile and digital wallets, in-app payments, one-click payments, auto-renewing subscriptions, contactless card payments, and other digital payment options.

The international marketing statistics portal, Statista, estimates frictionless payment technology will grow to $8 trillion by 2024. Their popularity, as described in Monei’s blog, is due to their:

- Providing a faster checkout (with fewer steps needed to complete checkout)

- Minimizing or eliminating consumer waiting time

- Reducing cardholders’ cognitive strain by eliminating the need for PINs or passwords

- Feeling like a natural part of the customer experience, instead of like an extra step

A deeper look into two of the top methods leading this customer-centric revolution is a must.

For more information on this and more payment trends, we have a new series of reports- Nordic Payment Report 2023- available for:

Sweden

Norway

Denmark

Digital Wallets

Digital wallets are financial applications that allow consumers to store funds, make transactions, and track payment histories on devices like phones and tablets. Apple Pay, which Nets offers to webshops on its payment platform, is an example of a more well-known digital wallet— as is Google Pay. Both services allow consumers to access financial products through physical devices and to make purchases.

Besides convenience and even rewards (think loyalty programs), they have the added security feature of not having to carry around credit cards, as the account information is stored in the cloud. This is possible through something called tokenization. Account information is heavily encoded — so much so that if a retailer gets hacked, the credit or debit card number won’t be compromised.

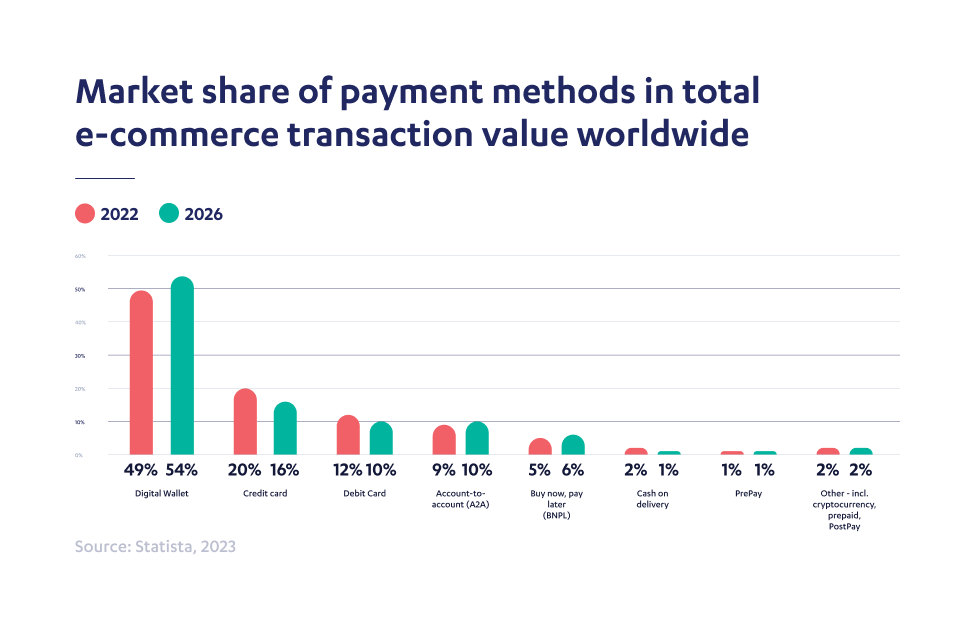

According to Statista, in 2022, mobile wallets accounted for roughly half of global e-commerce payment transactions. This makes the digital wallet by far the most popular online payment method worldwide with a share set to increase to over 54% in 2026. Although digital and mobile wallets were globally the leading choice when buying online, some regions used this payment method more than others. It is the most popular method in the Asia Pacific Region, accounting for approximately 60% of e-commerce transactions in 2020, compared to 20% of online transactions in Latin America.

Embedded Payments

Embedded payments, also known as in-app payments, enable seamless payments within apps and platforms by integrating payment infrastructure. Taking out a credit card and entering its number is a friction point that can cause consumers to abandon a digital purchase should their card not be handy. Embedded payments make this process much easier, as no card is required.

Embedded payments are a way of connecting and saving a payment method for later use at the click of a button. The Starbucks app, for example, saves credit or debit card information for 1-click payments while customers earn points for using the app. Another, perhaps more widely used example, is that of Uber for ordering transportation. Consumers order and pay for a ride without leaving the Uber app. The act of paying becomes invisible to the customer. (They enter in their payment information once when they download the app and register for the service.)

As smartphones continue to rule the digital world*, the popularity of in-app purchases has changed how we use mobile apps and make transactions—transforming the user experience. Benefits are:

- Convenience and Frictionless Transactions: Without leaving the app or repeatedly entering payment information, users can make purchases, subscribe to services, or access premium features.

- Improved App Engagement and Retention: Users are more likely to stick around and keep using an app if it offers simple purchase processes, which raises the lifetime value of those users.

- Personalization and customization: Apps can offer customized recommendations, offer individualized discounts or loyalty benefits, and make repeat transactions easier by securely storing user payment information.

For more information on in-app payments in the Nordics, refer to our in-depth article by our Head of Product, Anders Knudsen here.

*According to Statista, in 2023, the current number of smartphone users in the world today is 6.92 billion, meaning 86.11% of the world’s population owns a smartphone.