1. What are some of the benefits of accepting local payment methods? Any challenges?

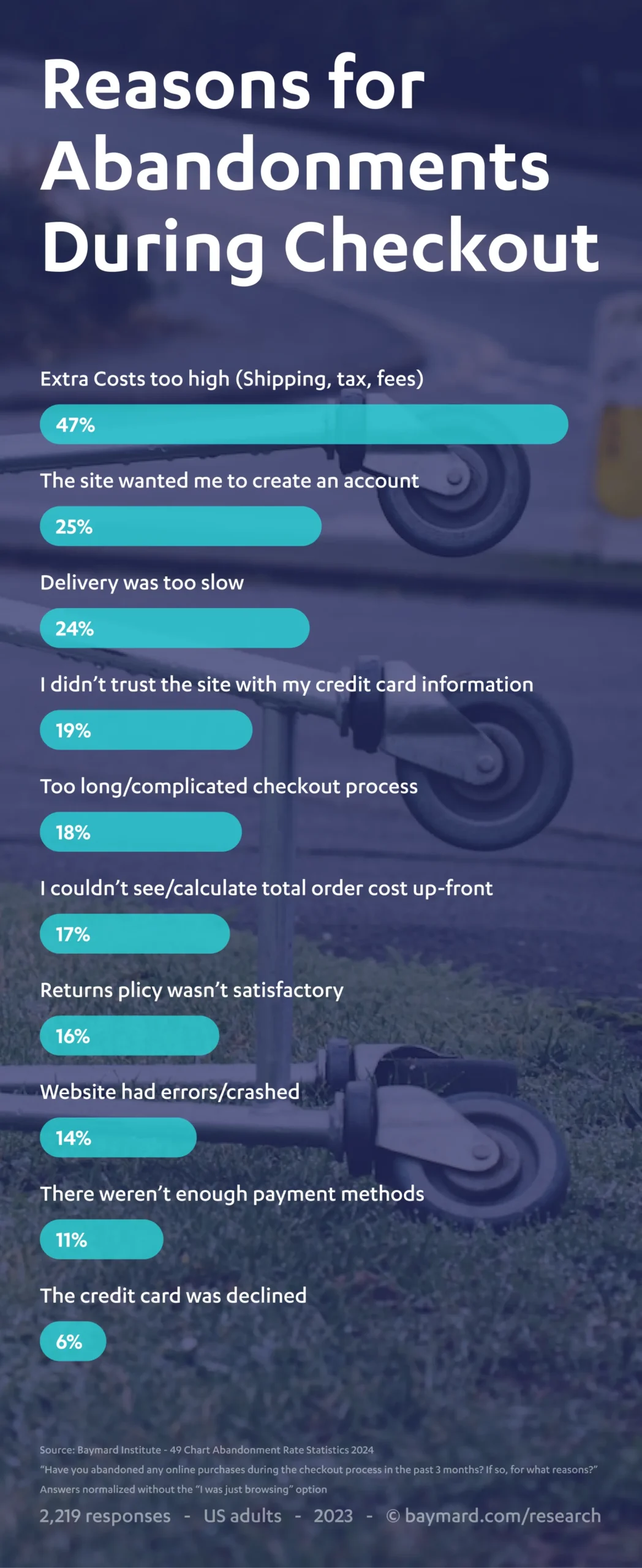

If we take a step back, the objective of a merchant (any merchant) is to be able to secure the sale of a product or service with as little friction as possible. They’ve done all the hard work that leads up to the checkout, i.e. the marketing, the website build, the customer journey flow, and the last mile of this journey is the payment. This is not the merchant’s forte, and it has no benefit in and of itself; in fact, the less you notice and spend time on paying the better!

Payment Service Providers, like Nexi, exist to ensure merchants can capture that marginal sale as quickly and seamlessly as possible. And increasingly today, at a fair cost too. Payment acceptance is the technical term for it, but in simple terms it’s ensuring the merchant has the right (number and type of) payment methods at the checkout. In today’s eCommerce, payment methods and other tools are global, regional and local. A consumer may use any of these payment methods for particular use cases, but increasingly we are seeing local payment methods become more prominent. Why?

Payments by nature are local, the way you bank and pay is very much determined by culture, history and the development of your (digital) economy. Local payment methods often benefit from:

- Originating with trusted domestic brands (often banks)

- Being ubiquitous (high population penetration)

- Incorporating ID verification (enabling smooth authentication)

These components of good payment experience lead to local payment methods offering a superior conversion rate versus their global and regional “competition“.

Local payment methods are not always the cheapest, but the sheer number of users and their preference for paying with local payment methods means merchants must offer it.

2. What kinds of consumer behaviour have you observed regarding local payment methods?

Given our strategy of „being local by nature, and European by scale“, Nexi is able to garner insights from across our footprint from the north to southern Europe. I regularly touch base with our local leaders to understand current market dynamics.

There are 3 points which are prominent in these conversations these days:

1. UX is (mostly) driving growth: local payment methods are nothing without the superior payment experience they offer. Consumers are not that ideological over payments, local-ness matters but not at the cost of convenience. This is why we’ve seen most local payment methods prosper in the form of easy-to-use mobile wallets. They hold a unique position in being able to offer this unique experience via significant cooperation between local banks. Alternatively, there are markets where slower (more complex) payment methods are preferred, e.g. Finland, where local bank-based (“A2A”) payments are the leader.

2. Payment use case matters: Payment decisions are implicitly complex. A consumer may love shopping with a particular payment method, but they may procure services (i.e. Subscriptions) with a totally different payment method.

This is what we see with local payment methods, they are super popular for one-off (eCommerce) purchases but not so much for recurring payments. For recurring payments, consumers tend to go with the more ‘traditional’ bank-centred methods. They come with a bit more control (in how to start and stop paying), but for the merchant they can also be more expensive. This is a space to watch as local and global (Apple Pay, PayPal) payment methods are now competing for consumer attention on Subscriptions.

3. Local Schemes don’t travel that well: Similar to use cases, one might initially think that preference when shopping domestically translates when shopping internationally. That’s not true. Consumers are sophisticated, they know what works where and why. Trust is lower when shopping internationally, and therefore what you pay with matters. Local wallets and payment methods may not always be present internationally – but they may not also be desired. Consumers prefer security over ease when trust is low. In this case, Credit Cards are preferred to local schemes, where the presumption is that a purchase (and ergo the consumer’s money) is protected by Visa, MasterCard and American Express rules.

There is not a “one size fits all”

in payments I’m afraid – understanding your customers (who they are, where they are from) is essential.

3. Do you find there are emotional or sentimental connections to local payment methods? If so, can you share your thoughts and observations?

I’m going to fall back on my economics training here, and refer to consumers as rational economic agents. There must be a reason to like or dislike a payment method, because paying is a not a valuable act in and of itself – it’s what you receive after the payment that matters.

So I wouldn’t say that consumers are emotional or sentimental about selecting a particular “local” payment method. Consumers need to be able to trust what they’re paying with (and whom to), and it needs to be simple to use. That will drive behaviour more than the flag or HQ location associated with a payment method.

Apple Pay taking up share of in-store payments across Europe is a clear example of that.

4. Is there anything you would like to say about how Nexi can help?

I’ve said a lot already about the principles behind consumer and merchant choices. You don’t want to offer Consumers too many options at the checkout that the process is confusing, but you don’t want to offer too few options and not enable your customers to pay the way they want to. It’s a delicate balance that needs experience and insight to get right.

Nexi has a long track record across Europe of working with Merchants small, large, domestic and international to get this balance right. We are by nature, local, and therefore offer all the local payment methods wherever we operate. We understand consumers, their preferences and behaviours to ensure that whichever industry a merchant is in, we know the way to support their sales in the most effective way possible.

We have a checkout that leads to higher conversion, with an added bonus that we also are able to offer advice on how to manage fraud best. So, whether it’s the status quo, a new set of target customers or expanding reach into new markets, we are always well placed to ensure our merchants get high performance payments.