European by Scale, Local by Nature

During Nets’ multi-city tour called NextUp: The future of payments, we had an opportunity to gather our customers and partners for an in-person, interactive learning experience and idea exchange. We held the series of events at premier, modern locales in all the Nordic capital cities to set the stage for discussing trends in the payment industry. We are excited to share how discussion about e-commerce fared during these events, as we held specific presentations to dive deep into the world of online shopping and online payments.

At the following locales, we demonstrated how we are European by Scale but Local in Nature— meaning we understand the intricacies of consumer demands and habits and payment preferences per country.

Take a look at each event page containing an overview video, photos, and filmed presentations (click the city name):

Copenhagen: March 14th at Tivoli Hotel and Congress Center

Stockholm: March 16th at At Six

Oslo: March 21st at Design og arkitektur Norge | DOGA

Helsinki: March 30th at Pikku-Finlandia

We are the European paytech

For us, considering the future of payments means truly understanding that shopping behaviors and payment preferences in Europe differ from country to country. It is not the “United States of Europe”— where perhaps a one-size-fits-all approach in one language and currency would function well. Enabling online payments in one uniform way simply does not work on this side of the Atlantic.

Local solutions that cater to customers’ demands and payment preferences are key to success (and are key to creating a win-win situation.) The added benefit of course, is in Nets’ ability to help merchants not only succeed in their home country but to expand their businesses easily to other markets by leveraging our established online payment systems and integrations.

Fireside Chat

We began each event with the respective Country Manager welcoming the crowd and zooming in on the business situation locally in order to illustrate Nets’ presence: 1,200 employees and 4 locations in Denmark; 235 employees and 1 location in Sweden; 286 employees and 2 locations in Norway; and 500 employees and 1 location in Finland through Paytrail.

The view from our experts was facilitated via our Head of Media Relations, Søren Winge, who moderated a panel discussion with our leadership: Omar Haque, CEO Group eCommerce; Roberto Catanzaro, CEO Merchant Solutions, and Torsten Hagen Jørgensen, CEO Issuing Solutions. Martin Pitcock, CMO eCommerce joined the conversation in Norway and Finland.

Søren asked many thought-provoking questions that helped educate the viewing audience, and his opening statement clearly explained the current situation as one in which we are “going digital”

“Since the start of the pandemic the pace of digitisation across Europe has clearly accelerated and so has the shift from cash to card. In the Nordics, it has been some years since cash was “king”— which is still the case in other parts of Europe. But even so, we have seen a further shift towards cashless and contactless payments. Consumers are starting to prefer digital channels and are shopping more categories online than before the pandemic. And banking customers are increasingly preferring digital channels to interact with their bank.”

Main Points

Becoming Future-Fit

Omar Haque explains that mobile is clearly becoming a preferred way of shopping, as for many— especially younger consumers— this is more convenient. Naturally, the merchant platform needs to be flexible (for example, both website and webshop need to be mobile responsive and quick to load) and the shopping experience needs to be as seamless as possible (the purchase can be finalised with only a few taps on the phone.) Omar states that we know from our customers that the less friction there is in the buying— or more specifically, the payment process— the higher the conversion rates.

Frictionless is Key to Conversion

We know that with changing consumer preferences, we need to continuously work to remove as much friction as possible from the buying process. This can be by retrieving customer information to not only pre-populate address and payment details but to individualise the shopping experience (think: offering additional recommendations, specific product ratings, and multiple payment options.) Key is also helping customers finalise their online purchases via their preferred channels.

Omnichannel Behaviour and the Shopping Experience

Consumers shift between channels – for example, researching a product on social media, visiting the company’s website, yet entering the retail location while using their mobile phone to research competitors’ prices. They can even order an item online but pick it up in-person at the store so as to try it on first. Omar stresses that this new concept increases the requirements for the online merchant and the payment platforms and solutions that we at Nets provide.

Would you like to view these fireside chats?

The filmed panel discussion from the Denmark event is available here. You can view the discussion from the Stockholm event here and from the Norway event here.

A Concept Called “Relay”

Our innovation center in our eCommerce business is called Nexi Relay. Ted Bowman, Relay CPO explained in his talk “Powering eCommerce for PSPs and Merchant” that:

- Doing business in eCommerce in Europe is complex.

- We have developed a unique way to address this complexity.

- We strive to provide more value to merchants.

Take a look at where we operate today and how we integrate all local payment solutions and partners to make e-commerce simple for our merchants, no matter where they decide to grow their businesses.

Yes, the European eCommerce market is fragmented, as Ted explained in his presentation. We at Nexi strive to simplify this for our partners and customers by:

- Maintaining local expertise with local front ends operating in our markets.

- Offering one shared service layer built for developers by developers powering the local platforms.

- Providing value back to merchants and partners through the growth of the features on the platforms we have today and increased pace of delivery.

E-Commerce Situation in the Nordics

Our speakers: Henriette Andersen– Head of Online Sales in Denmark; Patrik Müller– E-commerce expert in Sweden; and Ardalan Fadai– Head of Online Sales in Norway discussed the local situation in terms of attitudes and behavior. From a drop in consumer spending due to the global pandemic, consumer spending has been recovering year over year. However, economic activity has not returned to pre-pandemic levels, and certain categories have been catching up more robustly (travel) while others have been falling (physical goods).

Along with a sneak peak into Nets’ 2022 research to connect the dots from previous years’ studies, our market experts also explained that although Nets is part of Nexi Group, the European Paytech, Nets offers merchants the simplest, fastest and safest e-commerce payment solutions, with: local sales and support; local market knowledge; and local payment options.

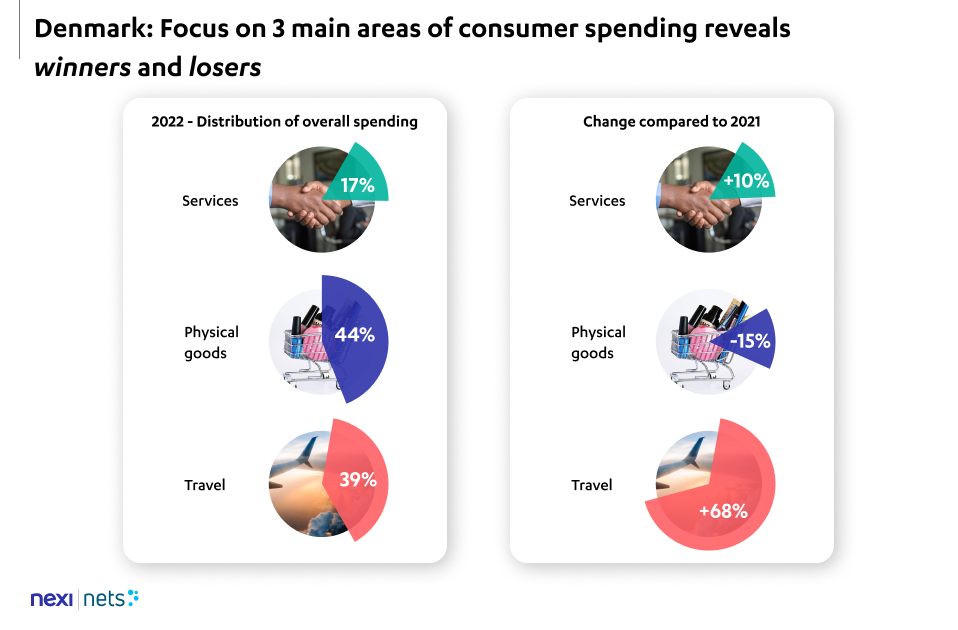

Local Insight- Copenhagen, March 14

In Denmark, consumer spending on Services, such as streaming services, memberships, and event tickets captured 17% of overall spending in 2022, according to our study. Physical Goods (groceries, beauty products, personal care items) comprised 44% and Travel represented 39% of consumer spending. The changes in spending, compared to 2021 are respectively: Services at +10%; Physical Goods at -15%; and Travel at +68%.

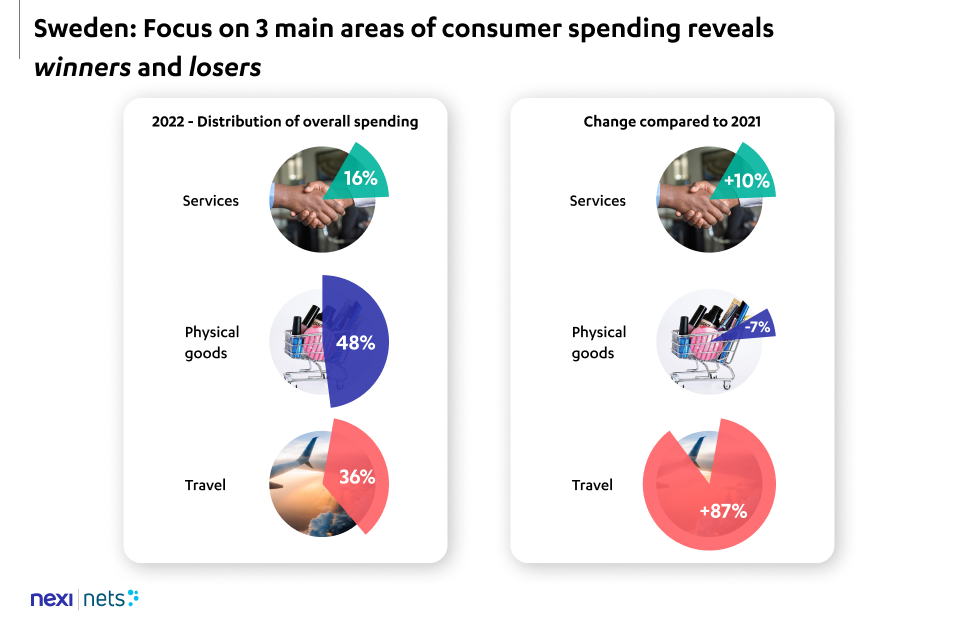

Local Insight- Stockholm, March 16

In Sweden, consumer spending on Services, such as streaming services, memberships, and event tickets captured 16% of overall spending in 2022, according to our study. Physical Goods (groceries, beauty products, personal care items) comprised 48% and Travel represented 36% of consumer spending. The changes in spending, compared to 2021 are respectively: Services at +10%; Physical Goods at -7%; and Travel at +87%.

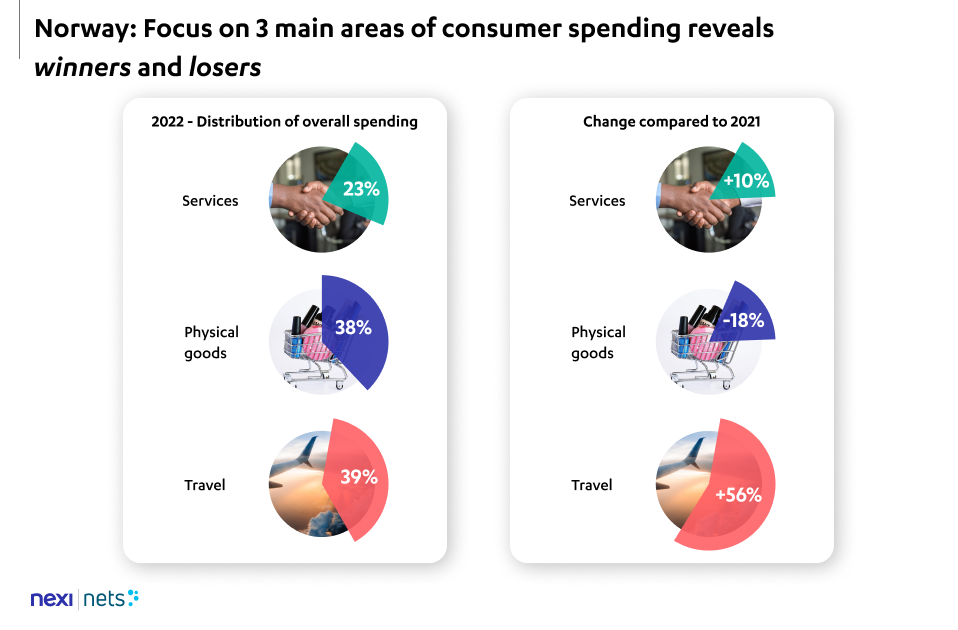

Local Insight- Oslo, March 21

In Norway, consumer spending on Services, such as streaming services, memberships, and event tickets captured 23% of overall spending in 2022, according to our study. Physical Goods (groceries, beauty products, personal care items) comprised 38% and Travel represented 39% of consumer spending. The changes in spending, compared to 2021 are respectively: Services at +17%; Physical Goods at –18%; and Travel at +56%.

It’s Not Just Checkout!

Our local experts closed their individual presentations by reminding the crowd that “For us… It’s not just checkout! The key to the customer shopping experience for more sales and customer loyalty— and less abandoned shopping carts!” And this is a statement we stand by; an enjoyable online shopping experience can simply become ruined with a clumsy and messy checkout as the final step.

At best, the customer becomes annoyed but completes the purchase. At worst, he or she abandons the shopping cart completely and never returns to shop again with that merchant.

The E-commerce Exhibit— With a Poll

We wanted to keep our fingers on the pulse of how our customers feel about upcoming trends and where the online shopping experience was headed. We create a 4-question poll which our customers participated in at the NextUp events in Stockholm, Copenhagen, and Oslo. Our findings are quite interesting, and some of them are surprising indeed.

(And we also gave away books to keep our customers inspired with creative approaches and ideas on generational dynamics, economics, virtual technology, and more!)

Customers Reveal their Ideas

What trends do they see having the most impact in 2023?

When asked to select two e-commerce trends that will have the most impact in 2023 from a list of choices, participants commonly pointed to:

-Social commerce (businesses selling products via social media platforms) for alternative access to webshops (49%); and

-Sustainability/ eco-friendly e-commerce operations (shipping, packaging, materials etc.) by brands for “guilt-free shopping“ (45%).

Interestingly, Voice assistants and voice search for finding products more easily was the trend that was least cited (therefore, not seen as impactful by respondents.)

Do they utilize omnichannel methods when shopping online?

Another area was omni-channel, which merges the e-commerce and in-store experience together. We asked respondents which from a list of experiences were most valuable to them:

-Buy online, pick up in-store (BOPIS) was selected by 3 of 10 respondents.

–In-store inventory availability information online was selected by 2 of 10 respondents.

The least interesting experience to respondents was Reserve online, try on in-store with just two respondents selecting this experience.

Sustainable E-commerce and Wish Lists

How do they feel about Sustainable E-commerce?

We were curious as to what affects on-line shopping decisions, and the answers did not surprise us. The clear majority of respondents (more than two-thirds!) selected either:

-Price, price, price— above eco-considerations in shipping, brand, packaging etc (37%); or

-Convenient delivery (regardless of environmental impact) (33%).

An effort to Find pre-owned articles first and consideration of Social responsibility of the brand were the least impactful on respondents’ buying behavior, according to their answers.

What’s on their wish list?

Lastly, we wanted to uncover respondents- wish lists by asking: “When shopping online, what do you wish webshops you visit would do more of ? ”. Half of respondents focused on shipping and returning of items ordered online. Answers reveal a tie between their wanting more:

-Shipping options (location pick-ups, home-delivery, post office) (25%); and

-Return handling that is easy (25%).

Live Shopping so that they could visualize the products, sizes, fabrics etc. was surprisingly not a top choice, and we can assume that though innovative, the concept has not “caught on” fully throughout the Nordics.

Continue Your Learning Journey

We learned a lot from our experts and from our rich discussions with our customers at all four NextUP: The future of payments events in the Nordics. If you would like to watch any of the presentations (in local languages) you can access them here at the following post-event pages: Copenhagen, Stockholm, Oslo, and Helsinki.

Of course, you can continue learning about the e-commerce landscape— and consumer behavior in specific— from our 2021 E-commerce Reports (the 2022 reports are coming out soon): European overview, Sweden, Denmark, Norway, Germany, and Austria.

In addition, the Nordic Payments Report can be downloaded here. It reveals payment method preferences, insight into the short-term effects of the pandemic and prospects for the future, as well as deep dives in various categories. Additionally, it discusses new payment methods like biometric payments and associated consumer attitudes.

Samara H. Johansson

Content Manager, Nets E-Commerce

With 15+ years of experience in strategic marketing and communications roles, for Nets I focus on presenting e-commerce market insights in a way that is easy to understand and practical.

- Topics:

-

Enhance your online payment experience.

Connect with our dedicated sales team to hear more about our tailored solutions and offers.

CONTACT SALESAvailable now

-